BlackRock acquires US storage space player

- Jupiter Power has an 11GW pipe of utility-scale projects situated across numerous states in America

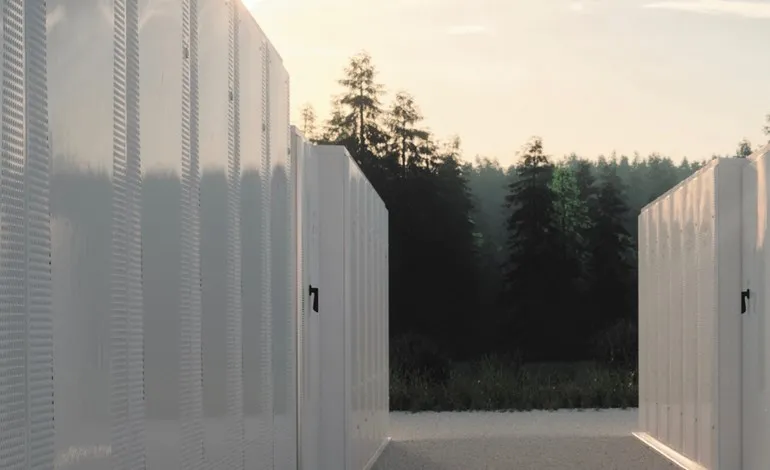

BlackRock Alternatives, with a fund managed by its Diversified Infrastructure business, has accepted acquire US energy storage programmer Jupiter Power.

EnCap Energy Transition Fund I (EETF I) and also co-investment companions Yorktown Partners as well as Mercuria Energy are marketing Jupiter, with the deal anticipated to close in late 2022.

Jupiter's group consists of 70 specialists with more than 25GW of previous power generation project experience internationally, including several of the initial utility-scale energy storage space projects integrated in the US.

The developer's pipe completes over 11,000 MW from California to Maine.

The company has and also operates a large storage space fleet in Texas consisting of 655-megawatt hours (MWh), and currently has 340MWh of new projects in or near building, including its very first project in California.

Earlier in 2022 Jupiter closed a stand-alone storage portfolio debt funding of its operating portfolio as well as introduced a partnership to protect 2,400 MWh of domestic-content-qualified battery energy storage space systems for its 2024-2025 projects.

" Purchase of Jupiter's uniquely capable energy storage platform by BlackRock's Diversified Infrastructure business is another indication that energy storage space is developing into a crucial new player in the electrical energy company with a critical role to play," said Jupiter Power chief executive officer Andy Bowman.

" Our group has special insight into the many useful points storage space can do because of our deep previous experience with renewable energy projects, and also we are proud to aid blaze a trail currently to the future generation of utility scale energy storage systems."

The procurement of Jupiter by BlackRock's Diversified Infrastructure business, part of BlackRock Alternatives, is the second leave purchase by EnCap's $1.2 bn EETF I.

Along with Jupiter, EETF I has actually backed leading energy transition business, including Catalyze Energy (dispersed industrial as well as commercial solar plus batteries), Solar Supporter (large scale solar), Triple Oak Power (utility scale wind power) and also Arbor Renewable Gas (clean fuels), among others.

Also read