Bitcoin mining to set you back less than 0.5% of global energy if BTC hits $2M: Arcane

- Bitcoin might be a considerable energy customer in 2040, yet only if its rate gets to several million dollars, according to new estimates by Arcane Research.

Bitcoin (BTC), the world's most-valued cryptocurrency, has the possible to be a considerable energy customer in the future, however just if it reaches a number of million dollars, according to new estimates by Arcane Research.

Crypto research and also analytics company Arcane Research on Monday released a report estimating the development in Bitcoin's energy usage towards 2040.

Authored by Arcane Research expert Jaran Mellerud, the report points out that Bitcoin's future energy consumption varies enormously depending upon the future Bitcoin cost alongside aspects like transaction fees, electricity prices and also others.

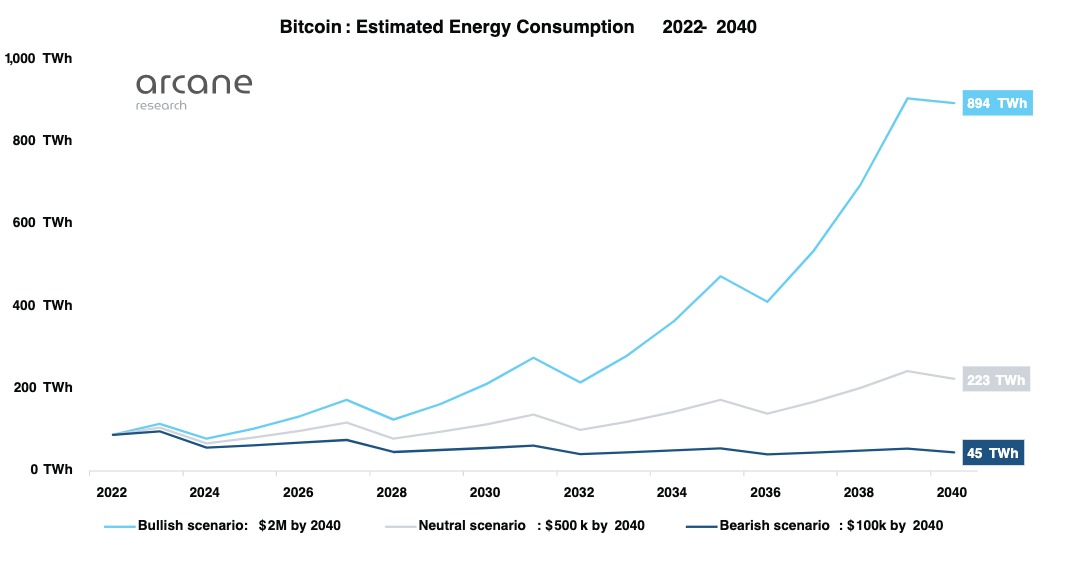

If the BTC price hits $2 million in 17 years, Bitcoin might eat 894 Terawatt-hours (TWh) each year, rising 10 times from today's degree, the report suggests. In spite of massive growth, such energy usage would only account for 0.36% of the estimated international energy consumption in 2040, increasing from Bitcoin's 0.05% share today, the expert approximated.

" Currently, based on their energy consumption of 88 TWh and a typical energy rate of $50 per MWh, Bitcoin miners invest around 50% of their revenue on energy," Mellerud noted.

Bitcoin's future energy consumption would be much reduced in much less bullish situations. BTC price would require to reach $500,000 by 2040 for Bitcoin to consume 223 TWh per year. If Bitcoin professions at $100,000 in 17 years, BTC mining would eat just 45 TWh per year, the report notes.

The analyst went on to state the substantial effect of the Bitcoin halving, a quadrennial event indicating a 50% reduction in miners' block incentive. According to the report, the BTC price must be rising at an incredible rate because of the halving, while halving's "mitigating effect" can be countered by expanding purchase fees in the future. "Such a rise will only occur if there is a considerable need for using Bitcoin as a repayment system," Mellerud composed, adding:

" The Bitcoin rate depends upon the market need for Bitcoin as a shop of value, while the transaction charges are driven by the use of Bitcoin as a cash."

As a shop of value and also a legal tender comprise two of the most vital functions of money, the report also recommends that Bitcoin's energy usage will only get to a significant level if Bitcoin succeeds as money.

As numerous BTC doubters think that such a scenario is hardly possible, they must not worry about Bitcoin's energy consumption, Mellerud hinted, mentioning:

" I have good information for those of you that want to see Bitcoin's energy intake decrease: You can relax in your elbow chair, due to the fact that your wishes will be met if Bitcoin stops working as a monetary system. As well as you believe Bitcoin will fail, don't you?"

The Bitcoin mining market has actually endured a major decline in 2022 amidst the ongoing cryptocurrency winter season, with many big crypto miners deciding to market their BTC holdings to continue running. Mining companies in the United States have additionally dealt with stress from regulators, with united state legislators requesting energy consumption data from 4 significant BTC mining firms.

Regardless of the progressively bearish environment, many Bitcoin miners are still positive concerning Bitcoin's short and also long-lasting cost viewpoint. According to Canaan senior vice president Edward Lu, the mining market is a "healthy and balanced and also profitable organization" in the long term.

Also read