Battered Clean Energy Stocks May Quickly Recuperate

- As the green sector stumbles, analysts are seeing acquiring opportunities.

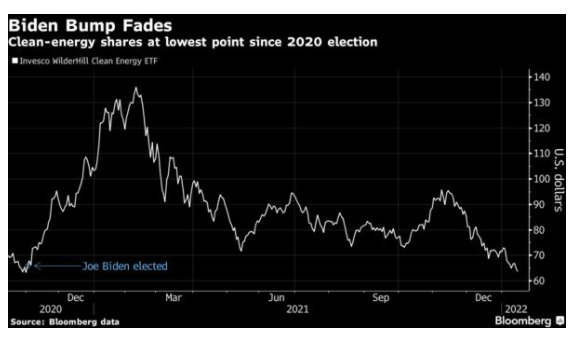

Clean energy stocks have been getting definitely clobbered.

2 indexes that track the sector-- WinderHill Clean Energy and also S&P Global Clean Energy-- have gone down 13.9% and also 8.2%, specifically, because the start of the year. From their market tops of early last year, the WinderHill index has actually plummeted 54% as well as the S&P index has decreased 39%. (For context, the Nasdaq Composite Index has actually fallen 9.6% from its high in November.).

The industry has been knocked by a combination of worries about greater U.S. rate of interest, a likely decrease in solar-system aids for California home owners, the more comprehensive stock exchange rotation out of high-growth technology firms and also the obstruction of President Joe Biden's stalled "Develop Back Better" schedule by 50 Republicans and two Democrats, Joe Manchin and Kyrsten Sinema. The problems appear to be outweighing any type of industry increase most likely ahead from application of Biden's enormous infrastructure program, which became regulation last year.

The outcome: Clean energy-focused exchange-traded funds have actually uploaded substantial outflows. Concerning $417 million was pulled from Invesco Ltd.'s $2.4 billion Solar ETF in December, the worst month in the fund's almost 14-year background. The $5 billion iShares Global Clean Energy ETF has actually endured concerning $195 countless discharges in the past month, according to information put together by Bloomberg.

Yet as proof of a feasible extended bearishness installs in this sector, analysts at companies including Morgan Stanley, BNP Paribas Exane and BMO Capital Markets are however seeing acquiring opportunities.

Morgan Stanley experts elevated their view of The United States and Canada's clean-tech market to "attractive" from "in-line," stating "we see solid development as well as assessments that broadly evaluate attractive regardless" of whether the united state Congress passes the "Construct Back Better regulations."

" We prefer stocks with strong barriers to entrance as well as little growth valued in," the experts wrote in a report issued last week. Those firms include AES Corp., Plug Power Inc., Sunrun Inc. and also TPI Composites Inc.

After substantial underperformance in 2021, "our company believe currently is an excellent time to selectively buy stocks in the field," according to Morgan Stanley's report released last week. "We see continued strong development for wind, solar, energy storage space, fuel cells, and also electrification modern technologies.".

Analysts at BNP Paribas Exane created last week that they advise "playing the renewable motif through the incorporated business, which are better hedged, branched out and more balanced." The firm updated its ranking on EDP Renovaveis SA to "outmatch" and spotlighted various other European business like Scatec ASA among "renewable pure plays." The analysts claimed financiers need to avoid smaller renewable firms such as Neoen SA and Solaria Energia y Medio Ambiente SA.

" While it is hard to recognize if we are close to the floor," the market's potential for growth "continues to be robust, renewables are still cost affordable, as well as need is as solid as we have actually ever before seen it," claimed experts at BMO Capital Markets, who concentrate on Canadian renewable-power stocks.

The experts preserved their favorable sight of Boralex Inc. and also Innergex Renewable Energy Inc., and updated their rankings of Brookfield Renewable Allies LP and Northland Power Inc. to "exceed" from "market perform.".

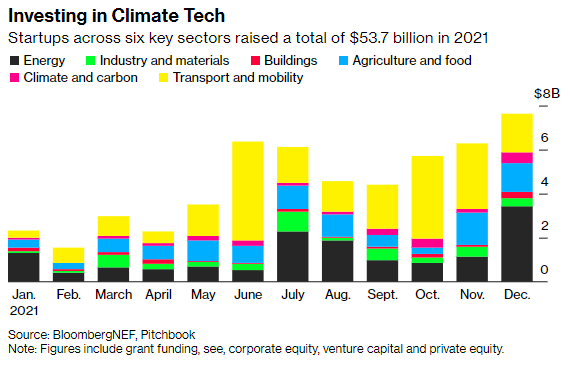

Indeed, stakeholders with a few of the lengthiest of long-lasting outlooks showed record-level bullishness in 2021, with equity capital financiers committing nearly $54 billion to start-up companies in the clean-tech market, according to BloombergNEF.

Last year saw "the increase of traditional capitalists taking stakes in environment technology," led by firms such as BlackRock Inc., Mubadala Capital, Sequoia Capital and Macquarie Capital, BNEF claimed. As well as there likewise was the production of a collection of climate-focused funds backed by General Atlantic, Brookfield Asset Administration as well as TPG Inc.

The best areas for new investment were low-carbon transportation start-ups-- nearly all electric vehicle business or related businesses such as EV charging-- in addition to renewable energy as well as food and farming modern technologies.

Lasting money in brief.

- Ray Dalio states "say thanks to god" oil is still pumping amidst increasing inflation.

- BlackRock chief executive officer Larry Fink concerns another letter on sustainable money, states there's nothing "woke" regarding stakeholder capitalism.

- Electricite de France SA was hit with a rankings alerting after France relocates to deal with energy crisis with price cuts.

- European Central Bank cardiovascular test to take a much harsher view on the environment situation.

- In spite of expanding environment fears, a survey reveals that global companies are struggling with just how to proceed.

Also read