Australian solar gives least expensive energy, sustains greatest frequency ancillary solutions payments

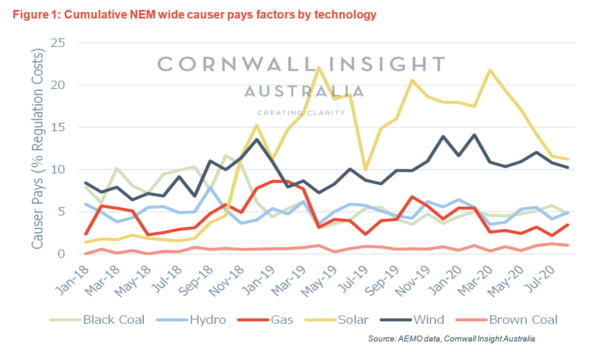

- New research from Cornwall Insight reveals that grid-scale solar farms are paying 10% to 20% of the expense of offering regularity supplementary services to Australia's National Electricity Market, regardless of currently creating around 3% of energy in the system.

Curtailment, connection hold-ups, marginal loss elements, a poor power transmission system, the ongoing Federal energy-policy vacuum-- the list of considerations and also potential detractors from the solar programmer's bottom line is ever before increasing. New estimations by energy experts Cornwall Insight currently locate that solar farms are overmuch carrying the growing expense of providing regularity control secondary solutions (FCAS) in the National Electricity Market (NEM).

Cornwall Insight reports that solar farms pay in between 10% and also 20% of complete guideline FCAS costs in any kind of provided month, when at this stage they generate only around 3% of energy created in the NEM. In comparison, wind farms gave some 9% of energy in the NEM during the fiscal year 2019-20, and also their collective FCAS causer pays tally involved around 10% of complete regulation prices.

The "causer pays" aspect refers to just how much any generator differs their linear ramp price to satisfy their next energy dispatch target for each and every send off duration.

" A new functional factor to consider for renewables is the obligation that high law FCAS costs position to the success of existing and future renewable resource jobs," says Ben Cerini, principal expert at Cornwall Insight Australia.

The firm's research shows that FCAS causer pays costs for grid-scale solar generators are cautiously around AU$ 2,368 (US$ 1,700) per megawatt every year, or around $1.55/ MWh. Nevertheless, this varies across NEM areas, with Queensland solar farms having greater causer pays consider monetary 2020 than those birthed in other states.

" Since 2018, regulation FCAS prices have changed between $10 million to $40 million a quarter," stated Cerini.

Splitting up anxiousness

Deploying FCAS allows the Australian Energy Market Operator (AEMO) to take care of discrepancies in generation or lots. The main contributors to the extremely high FCAS expenses of the very first quarter this year were three unforeseen "splitting up" occasions. Multiple transmission lines in southern NSW tripped as a result of the bushfires, dividing north from southerly regions of the NEM on Jan. 4. Then, the most costly splitting up took place when South Australia and also Victoria were islanded for 18 days, adhering to a tornado that maimed transmission lines on Jan. 31. Ultimately, the separation of South Australia and also western Victoria's Mortlake Power Station from the NEM on March 2.

When the NEM operates as a linked system FCAS can be sourced from throughout the grid, allowing AEMO to call on the most affordable offers from companies such as generators, batteries and lots. During splitting up events, FCAS needs to be locally sourced, as well as when it comes to the 18-day splitting up of South Australia as well as Victoria, it was met by increased supply from gas-fired generation.

Therefore, NEM system costs in the very first quarter were $310 million, of which a record $277 million was chalked up to FCAS required to preserve grid protection in these amazing scenarios.

The go back to a more common system costs tally of $63 million in Q2, of which FCAS composed $45 million, was "primarily because of the absence of incident of major power system splitting up occasions", stated AEMO in its Q2 2020 Quarterly Energy Dynamics report.

Large-scale solar

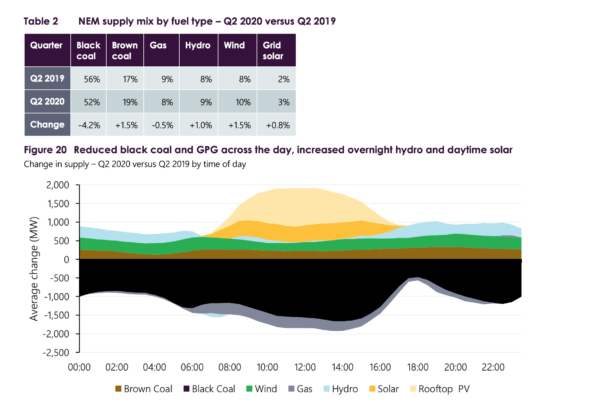

At the same time, the 2nd quarter saw the average local wholesale power area costs reach their lowest levels given that 2015; and 48-68% less than they remained in the 2nd quarter of 2019. AEMO listed the contributing variables to lowered wholesale rate deals as: "reduced gas as well as coal costs, alleviating of coal constraints at Mount Piper, enhanced rains (as well as hydro outcome), as well as new renewable supply".

Grid-scale variable renewable energy outcome (wind and also solar) boosted by 454 MW in the 2nd quarter, representing 13% of the supply mix, up from 10% in the second quarter of 2019.

Lowest-cost renewable energy will just boost its payment to reducing wholesale energy prices; as well as a more dispersed and also strengthened internet of interconnected transmission, together with changed policies governing battery connection in the NEM, hold the key to making sure access to competitively priced FCAS as required.

In the meantime, Cerini claims developers and also capitalists are carefully keeping an eye on any raised dangers to forecast prices. "As wholesale costs have actually dropped, prospective power purchase tenures have reduced, and also loss factors have actually fluctuated," he clarifies.

Cornwall Insight has flagged its purpose to provide FCAS rate projecting starting in September 2020, although the type of occasions which triggered FCAS to surge in the first quarter are tough to prepare for.

"FCAS liabilities are now securely on the due diligence schedule," Cerini claims.

Also read

- Renewable Energy Investment Hits Record-Breaking $358 Billion in 1H 2023

- 2023 Solar to Surge to Record 270 GW

- Japan's Low-Cost Net Zero Path: Wind & Solar, EVs

- Indonesia, India & China Account for Almost 70% of Demand for Floating PV in '22: WoodMac

- SIDS to Strive for New Goal of 10 GW Renewable Energy Installed Capacity by 2030