Asian buoyancy floats solar

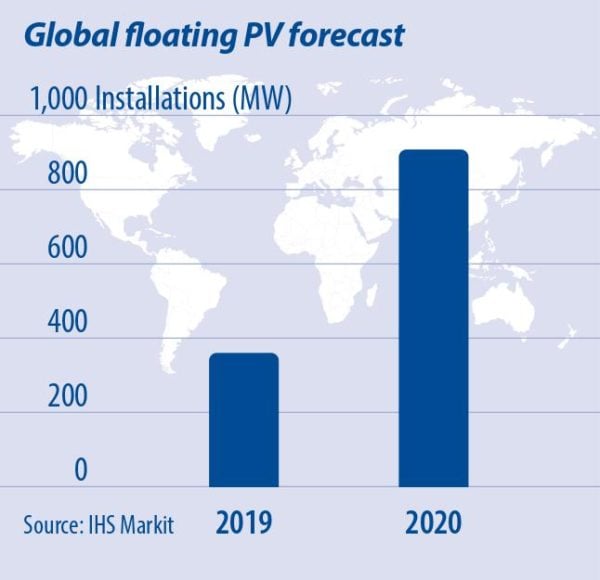

- Global drifting PV installations are readied to jump by 143% from 2019 to hit greater than 900 MW of annual ability enhancements this year, according to IHS Markit's Floating PV Report-- 2020. Development has been driven in recent years by a surge in the variety of drifting PV systems set up in countries such as China, South Korea, Japan, and also the Netherlands, with overall worldwide installed ability getting to about 1.5 GW at the end of 2019. IHS Markit Study Manager Cormac Gilligan as well as Senior Citizen Expert Chris Beadle take a look at exactly how these countries have taken the lead, with developers building huge quantities of drifting PV, while also installing pilots to much better understand the modern technology as well as test its abilities and also cost-effectiveness.

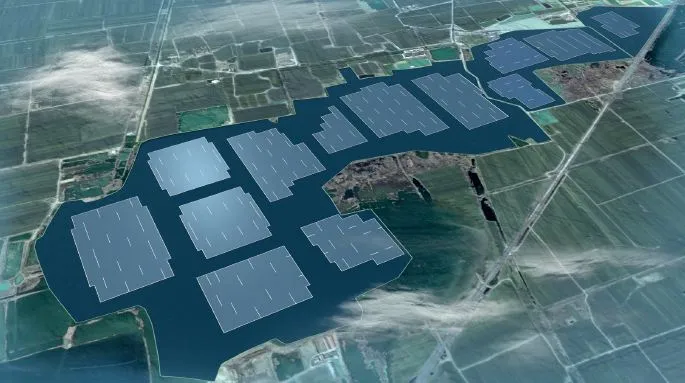

Floating PV (FPV) represents an expanding possibility for programmers to install solar in countries that encounter land constraints. In particular areas that have favorable conditions-- such as water bodies with closeness to existing grid links, including hydropower dams or water treatment plants-- it is likewise advantageous, as drifting PV can utilize existing framework to make it much more cost-competitive. Offshore installments at the pilot phase are showing effective and also are being carefully kept an eye on as they boost in size.

Nonetheless, sometimes FPV will certainly remain to be a reasonably specific niche innovation, as countries as well as programmers consider it a fairly pricey method of mounting solar compared to ground-mount and also rooftop solar, specifically with regard to stringent demands for securing, insurance policy, permits, and water surface area civil liberties.

Larger projects

New records remain to be broken as both suppliers as well as developers increase their understanding relating to the abilities of FPV modern technology. Presently, China holds the record for the largest floating PV setup of 150 MW in Anhui province, yet this is readied to be exceeded by a 180 MW installment in Taiwan-- because of be finished in 2020-21-- making use of both Sungrow as well as Ciel et Terre floats. BayWa r.e. currently has the biggest FPV project in Europe, finished in the Netherlands, at 27.4 MW in dimension.

Technical improvements are also improving FPV's attractiveness in terms of business economics and site area. For example, the biggest tracking floating PV (a system with turning drifting PV islands that follow the sun during the day) installment is currently under construction in the Netherlands, at just under 23 MW in dimension. Also, overseas floating PV pilots have actually been installed in the Dutch North Sea and are being set up in the United Arab Emirates.

China controls

China kept its ranking as the largest market for drifting PV for the 3rd year straight in 2019. Its rate of installations fell in 2019, compared to tape-record setups in 2018, owing to the basic decrease of the Chinese PV market adhering to policy support unpredictability in 2019 and also the removal of the Leading Jogger program, which assisted incentivize making use of high-end technology. In general, China's installed floating PV base is approximated to be dual the following 11 countries, with collective installations of greater than 5 MW. The nation remains to mount big amounts of solar on and over water, however a number of these installations lie on heaps as well as not floating places.

Arising chances

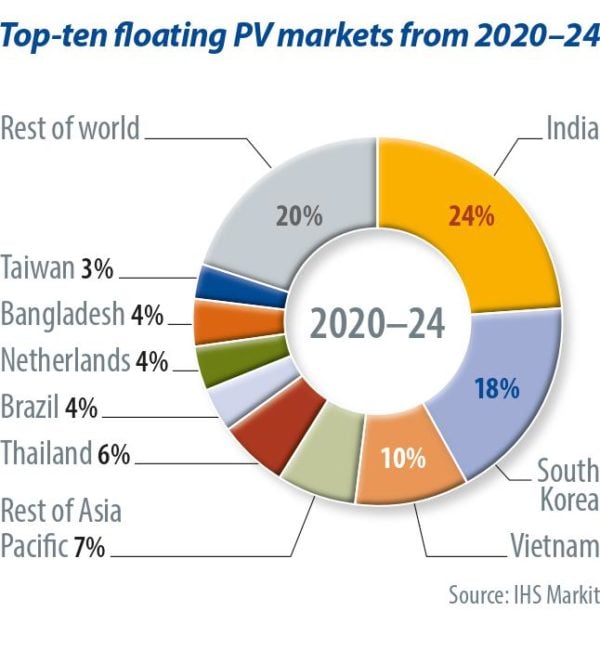

IHS Markit expects Asia to represent more than 70% of complete floating PV installments in the next five years. The top three markets are anticipated to be India, South Korea, as well as Vietnam, which will certainly make up over half of overall setups if development and conclusion continues as intended. IHS Markit is tracking over 300 floating PV projects internationally in its solar deal tracker, from early-stage growth to unfinished, that will certainly be completed within the following five years. The mass of them are greatly concentrated in Asia. Tenders and also auctions are expected to be the primary vehicle drivers to help the fostering of drifting PV in several Oriental markets, however after effects from Covid-19 may moisten the rate of setup of floating PV.

Outside of Asia, the vital markets will be the Netherlands, which has established itself a hostile target for drifting PV with its wealth of shallow inland water and its assistance through the SDE+ aid plan. Brazil is expected to be the biggest market for drifting PV in the Americas as a result of its siting of drifting PV on hydropower plant websites.

Both Ciel et Terre and also Sungrow continue to dominate the international market for drifting PV mounting vendors, collectively making up 70% of all finished or under-construction setups. Sungrow remains to have the biggest installed base due to its huge market share in China as well as in other Asian markets, yet Ciel et Terre has the widest global impact of all floating PV mount vendors. Most of the various other floating PV mount vendors are headquartered in early-growth floating PV markets such as China, Japan, and South Korea.

Favorable overview

Floating PV setups are anticipated to grow highly in the coming years as a result of an increasing pipeline of global tasks. Much of the biggest planned installments are dealing with delays with tenders, site obstacles, and financing, yet assumptions are high for record-breaking floating PV systems to begin building quickly. Floating PV might not be the cheapest technique of installing solar, yet its advantages can exceed the challenges. In lots of nations, especially in largely booming locations, there is an appetite to use this innovation. This is especially true at websites that are close to grid link points, making jobs economically feasible as well as weather patterns a lot more convenient. Disused mining websites, hydropower plants, shallow inland waterways, and manmade reservoirs are amongst the many areas that are thought about eye-catching, while offshore floating solar is being tested and also examined even more.

Chris Beadle & Cormac Gilligan

Also read