As nations reopen, market recovery starts

- As the Covid-19 pandemic slowly alleviates, countries all over the world have slowly begun to loosen up lockdown steps. Some nations have also released differing kinds of financial stimulation to sustain the solar industry. As opposed to others, the Chinese market is secure, as the country has had some success in controlling the infection.

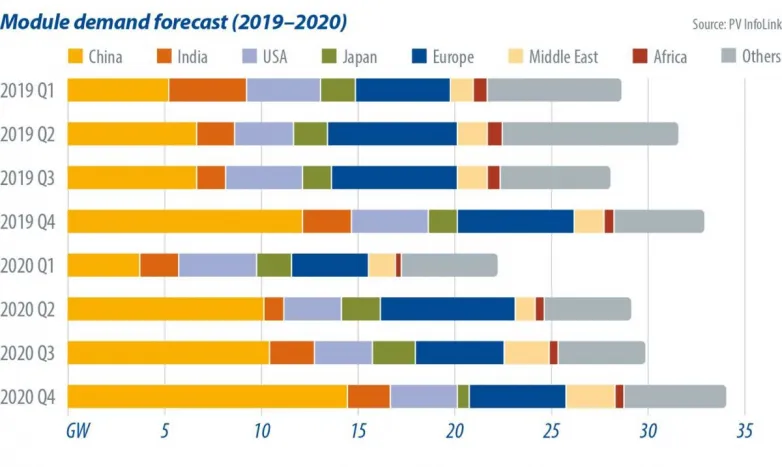

With need ending up better than expected in the 2nd quarter and also the spread of Covid-19 slowing in some abroad markets, PV InfoLink has actually elevated its projection for annual global component need to 121.1 GW. While Chinese need is projected at 43 GW in the meantime, this may be available in also greater if utility-scale projects begin building smoothly in the third quarter.

Steady speed

China's solar industry endured relatively couple of impacts from the pandemic, with module producers remaining to perform at high prices of utilization and also the grid-connection deadline for PV projects staying unchanged.

Chinese need in the first fifty percent of the year generally came from last year's projects that were rushing to attach to the grid as well as safe and secure payment by the June 30 target date. After the June 30 setup thrill, demand in the second half of the year will depend on brand-new projects released in 2020.

China revealed its solar plan for this year in very early April, but the government did not move the public auction schedule previously compared to last year as a result of the impact of Covid-19. The outcomes of the solar auctions are expected to be published at the end of the second quarter, and also taking into consideration the management treatments, demand from auctioned projects is most likely to manifest at the end of the 3rd quarter.

Residential, ultra-high voltage, and also grid-parity projects will get the slack throughout July as well as August. Considered that the commissioning due date for brand-new projects granted this year is set for the end of 2020, project developers will certainly attempt their ideal to finish installments in order to get payments by the end of the year. In this instance, the last quarter will see the highest demand in the year, with newly auctioned projects composing most of this demand.

In general, the demand level in China this year is more powerful than in 2019. PV InfoLink projects that China will certainly have 43 GW of module need, while lots of solar producers believe that it could reach as high as 45 GW.

Steady recuperation

Countries around the world have launched solar stimulus packages following Covid-19, as part of wider transfer to reactivate their economic climates. As the virus break out subsides overseas, developers beyond China have begun to proactively ask for acquisition quotes again. However, solar installation jobs will certainly be reduced because of continuous cross-border problems and also partial constraints in logistics.

Europe is amongst the areas that was hardest struck by the pandemic. However, China shipped 3.3 GW of modules there in April, a volume that was more than forecasted. Deliveries to the standard prominent European markets such as Spain as well as Germany have stayed secure, resting at 410 MW and 383 MW, specifically. This indicates that the impact of the pandemic on the European solar PV market is so far smaller than anticipated. Nonetheless, this situation could be the outcome of designers building component stock ahead of time. If this holds true, delivery quantities might fall in the 2nd fifty percent of the year. Various other markets consisting of the United States, the Middle East, as well as Australia, are likewise showing indicators of recovery. They are likely to return to normality in the second fifty percent.

The scenario in Latin America is fairly the opposite. The region's national politics as well as economy took a heavy impact in the middle of infection outbreak and also oil price collision. Demand damaged in April, with overall component delivery volumes from China to Brazil, Mexico, and also Chile having went down nearly 75% contrasted to March. India's further expansion of lockdown has likewise hindered its need healing. Contrasted to March, China's exports of modules to the nation plunged by 65% in April. The situations in these markets, nonetheless, did not change the truth that overall need in Q2 made out much better than originally anticipated.

In fact, China exported 6.3 GW of components to abroad markets in May-- the like in April. It deserves noting that the shipment quantity to Latin American countries in addition to India seems to have actually bounced back, although it remains to be seen whether the volume level will certainly continue to be secure or perhaps raise in June. It is near that China's exports of modules in June will be more than in May, as a lot of countries had loosened up lockdown actions by the start of the month.

It is anticipated that markets will certainly be totally reopened in July. As overseas markets begin grabbing throughout the 2nd to very early third quarter, demand will transform much better at the end of September and also get to the peak of the year in the last quarter.

Deferred demand

With the pandemic being slowly contained in numerous countries, global demand is most likely to expand each quarter in the 2nd half. Nevertheless, as demand from several projects have actually been postponed by the pandemic to the very first fifty percent of 2021, the recovery will stay sluggish at the beginning of the third quarter and start to climb, with need getting to the highest level of the year in the 4th quarter of the year.

The impacts of Covid-19 on the worldwide solar market might yet proceed right into 2021. Regardless of being hammered by the virus situation, the world's progression towards a low-carbon and lasting future continues to be unmodified. Solar energy, which has seen substantial decreases in ahead of time expense as well as LCOE in recent years, will certainly continue to blaze a trail in the long-term.

Also read