Array Technologies to launch US$ 100m IPO

- US-based solar tracker manufacturer Array Technologies is seeking to raise as much as US$ 100 million with an initial public offering (IPO).

Papers submitted with the United States Securities Exchange Commission (SEC) the other day (22 September 2020) expose that the firm means to note on the Nasdaq exchange under the ticker ARRY, with the business's moms and dad ATI having looked to banking titans Goldman Sachs, J.P. Morgan, Morgan Stanley, Credit Suisse, Barclays and UBS Investment Bank to promote the raise.

Variety Technologies is to seek financial investment from existing investors via the offering, with internet proceeds made use of to prepay some of the outstanding amount of the company's new initial line term lending. Any type of rest utilized for basic company purposes, including to bolster functioning capital, overhead as well as any type of capital expenditure.

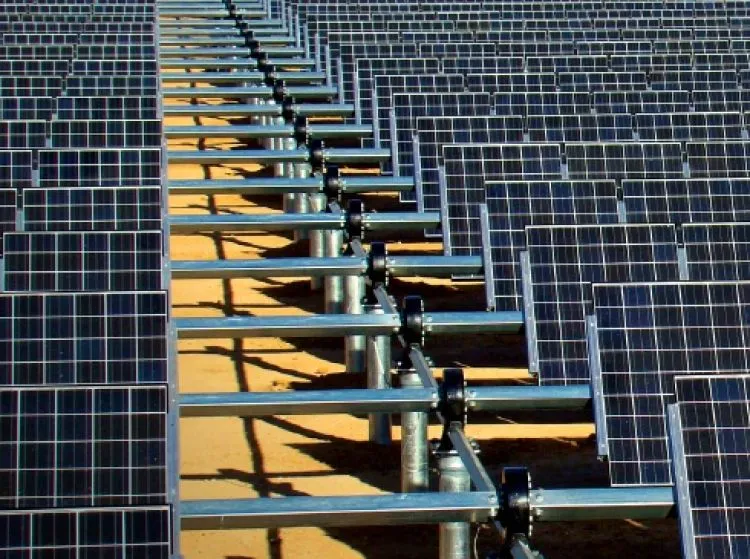

An investment prospectus highlights a number of the company's DuraTrack system advantages, namely the demand of fewer electric motors per megawatt mounted than completing items, automated stowing throughout high wind problems and high item integrity via making use of less components.

Selection likewise attest to allowing higher power density than other trackers on the market, with the company flaunting 5% more power per acre than various other tracker styles.

The program takes place to go over the business's approach, specifying that it will aim to utilize its patented innovation as well as international supply chain to grow into global markets. In 2019 around 87% of Array's profits originated from its native US market, however it notes that-- leaving out China-- the market for ground-mounted planetary systems was four-times the size of the United States market in 2019. The firm currently wants to lean on existing connections with job developers as well as EPCs to expand its international emphasis.

It also means to produce new income streams to offer its mounted bases, paying details focus to additional products, software application as well as solutions related to its tracker systems. Such a relocation would certainly adhere to in the course of various other firms such as Nextracker, which have actually released additional solutions to rest along with its hardware proposal.

Range has actually likewise recommended that it may want to release items or enter markets that it doesn't already provide for, such as foundations or other components used in balance of system, or other types of mounting and support for electrical infrastructure. These launches could be done either through the development of new products internally or through M&A activity, the company has said.

The prospectus also provides a snapshot of its performance to date, confirming that total revenue for 2019 stood at US$ 647 million. The company looks set for a significant rise this year, however, with revenue for the six months ended 30 June 2020 standing at US$ 552 million, more than double its revenue figure in H1 2019.

Gross profit in 2019 stood at US$ 150 million, while Array's H1 2020 gross profit stood at just over US$ 140 million.

Also read