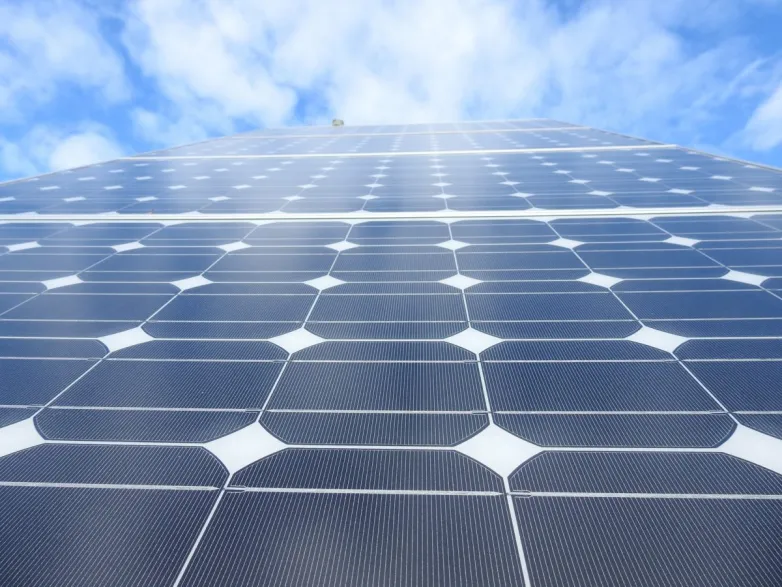

All that solar jazz

Sep 27, 2019 01:33 PM ET

- As 2019 enters its final quarter, the solar industry continues to face headwinds, even as the markets for solar deployment in Europe, the United States, and Australia remain strong. Paula Mints of SPV Market Research takes us through what to expect up until 2021.

The global economy is an intricate web of alliances, and one ill-advised trade move will eventually trickle through all of it. The U.S.-China trade war continues to risk slowing down growth, not only for the two countries involved, but also for other global economies. Economies in the EU are also particularly vulnerable as the U.K.’s exit nears.

In 2019, several tenders worldwide were canceled or delayed because of inadequate transmission and distribution networks. Infrastructure concerns are high for conventional energy; solving the problem is critical for continued solar industry growth. Unfortunately, governments often offer tenders without exploring the capability required to support the deployed solar.

China, India, Europe and the United States are currently the four most significant markets for solar globally. And all four are vulnerable to market shocks.

Emerging markets in Latin America, the Middle East and Australia are currently experiencing accelerated growth; however, each market has vulnerabilities that could stall growth in the near term. For example, Mexican President Andrés Manuel López Obrador recently halted an auction for renewable technologies and stated a preference for oil and gas over renewables.

China, as it continues to stabilize its domestic market for solar deployment, is experiencing a slowing economy that is complicated by ongoing trade tensions with the United States.

India’s economy and politics remain unstable and its market for solar deployment highly vulnerable to underbidding on tenders (unprofitability). It is also plagued by administrative hurdles common to all construction in India, a lack of participation by manufacturers, and low-quality components and installation practices.

Activity in the United States is accelerating in anticipation of the planned decrease of the Investment Tax Credit, even as the ongoing trade war with China pushes module and other component prices up.

The chart above presents the global forecast for grid-connected PV deployment from 2017 through 2021. It focuses on the grid-connected market, as it is >99% of PV deployment globally. The decrease in demand in 2018 was the first market slowdown in 50 years for the solar industry.

Paula Mints

Also read