AES declares 7-9% yearly development rate and also upgrades renewables target

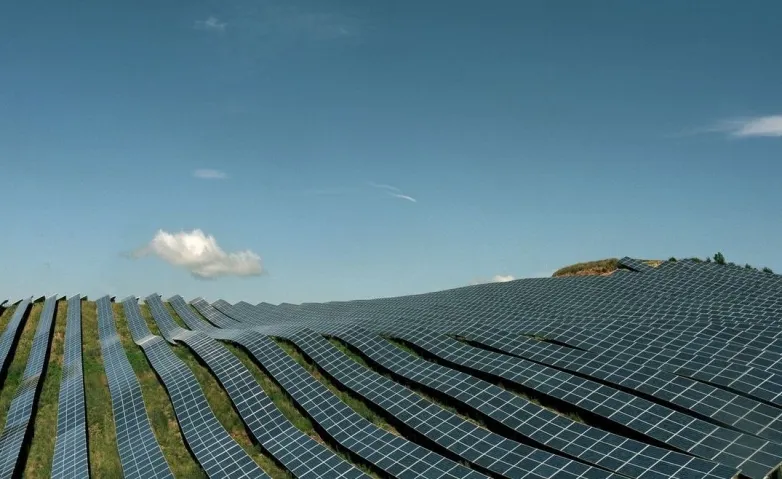

- Energy tech firm AES has reaffirmed its annual development target of between 7-9% through to 2025 and also anticipates to add 5GW of renewables, up from a previous target of 4GW, under lasting agreements this year after carrying out much better than anticipated up until now, according to its Q3 results launched the other day.

The Arlington, Virginia-based business is declaring its 7% to 9% annualised development rate target through to 2025, from a base year of 2020, and also has actually adjusted its EPS guidance, a non-GAAP measure, of US$ 1.50 to US$ 1.58 per share.

It now, nonetheless, expects to be at the reduced end of that array because of an "updated interpretation of accounting literary works" that thought these additional shares would certainly be consisted of only upon settlement of the equity devices in 2024.

"Based on our present outlook, we are certain in our 7% to 9% annualized development target through 2025," stated Andres Gluski, AES president and also chief executive officer.

Year-to-date, AES has authorized 4GW of new PPAs for renewable resource projects, enhancing its stockpile to 9.2 GW and also consequently has actually increased its whole 2021 target to 5GW.

"With our development year-to-date, we currently expect to include 5GW of renewables to our backlog this year, standing for a 25% boost from our previous target and 66% greater than in 2020," said Gluski.

The firm's 9.2 GW stockpile is anticipated to be finished by 2024, this includes 2,645 MW unfinished and 6,568 MW of renewables under lasting PPAs.

Given that this time around last year, AES has actually completed the building and construction or purchase of 643MW of renewables and energy storage, consisting of a 344MW solar and also solar-plus-storage project in the United States, a 59MW solar center in Colombia, a 58MW solar site in the Dominican Republic as well as a 159MW wind farm in Brazil.

As well as, since its Q2 revenues contact August, the firm has actually signed 1,088 MW of renewables and energy storage space under long-term Power Purchase Agreements (PPA).

AES' energy storage joint endeavor Fluence finished it's Initial Public Offering (IPO) in November, with AES retaining about 34%.

In November last year, AES combined its US-facing clean energy advancement company with independent power manufacturer sPower, producing a system with a 12GW project pipe in the country.

And in July this year, it made a tactical financial investment in 5B, an Australian energy start-up that produces modular 'plug as well as play' solar solutions.

Also read