5 Best Solar Stocks to Acquire in December 2021

- While solar supplies were solid in 2020, they have actually whipsawed in 2021. The year started off well for solar supplies and also Joe Biden's choice to rejoin the Paris Climate Deal resulted in a rally in all green energy stocks.

Nonetheless, the sector came under pressure thereafter, partly as a result of a sell-off in development names. There was some energy last month after the COP26. With 2021 now waning what are the 5 finest solar stocks that you can buy in December?

Maxeon

Maxeon was dilated from SunPower in 2020 just as well as makes solar panels. The supply has had a miserable ride as a publicly-traded firm. After a weak 2020, it has remained to fall in 2021 likewise as well as is presently down 40% for the year. Meanwhile, Financial institution of America finds value in this beaten-down solar supply.

" Our company believe excessive of the focus and the current stock efficiency has been tied to the sentiment and expectations around the BBB (Build Back Better)," claimed Bank of America expert Dumoulin-Smith. He included, "MAXN still has a hidden core of the business that is slated for a turnaround by YE22. The brokerage firm thinks that MAXN uses an excellent entry factor after the crash and the marketplace concerns over the balance sheet are unfounded.

" While some investors have expressed issues over the cash restraints, we believe that the core business is self-sufficient over the next twelve months in terms of the cash money needs, which de-risks the balance sheet," claimed the note.

According to the price quotes compiled by Koyfin, Maxeon's profits are expected to climb 56% in 2022 and also 25% in 2023. The predicted growth looks attractive as well as Maxeon could be among the beneficiaries if the Build Back Better bill passes.

Enphase Energy

Enphase Energy supply is up 22% for the year which is somewhat listed below the S&P 500's returns. That stated, while the S&P 500 is near record highs, ENPH is down 24% from its 52-week highs and remains in a bear market area. Nevertheless, analysts see the supply moving greater and also its mean target price of $280 is a 31% premium over present prices. Wall Street experts have an agreement buy rating on the stock and also it has 21 buys, 9 hold, and one sell ranking.

ENPH is a good solar stock for the long-term.

Enphase Energy is an excellent solar stock for the long-term. It is the globe's leading vendor of mini inverter-based solar and also battery systems. The company has actually shipped over 39 million microinverters which is an exceptional accomplishment.

Meanwhile, ENPH is likewise increasing in the EV charging market, and previously this year it revealed the purchase of ClipperCreek, which supplies EV charging options. There has actually been a superb rally in EV billing supplies after the $1 trillion bipartisan infrastructure bill was passed. Experts expect the business's incomes to increase over 40% in 2022. The supply trades at an NTM (next-12 months) PE multiple of 77x which looks practical taking a look at the expected growth.

ENPH is a fast-growing firm as well as is broadening both naturally along with inorganically. If you are considering a fast-growing solar stock at affordable valuations, ENPH looks like a good wager.

First Solar

First Solar supply is trading flat for the year. The supply had increased in the first fifty percent of November amidst positive outlook over the framework bill. However, it soon pared gains in accordance with various other solar stocks. The recent accident is a good possibility to own this top quality solar supply. Agreement approximates call for an upside of 20% over the next year also as the majority of experts rate the stock as a hold.

First Solar is an economically strong solar firm.

First Solar has a strong balance sheet that makes it an attractive wager. The NTM PE multiple of 42.4 x additionally looks reasonable. The company missed its third-quarter income estimates in the middle of the supply chain concerns. However, it preserved the 2021 net sales assistance and also expects to upload revenues between $2.88-$ 3.1 billion in the full year. It expects to supply in between 7.6-8 gigawatts of items in the full year. In the third quarter, the company shipped 2 gigawatts in spite of the supply chain issues.

Overall, FSLR looks like a good solar stock to include in your profile at these prices. Short-term volatility regardless of, the stock can supply great returns over the long term.

Sunnova

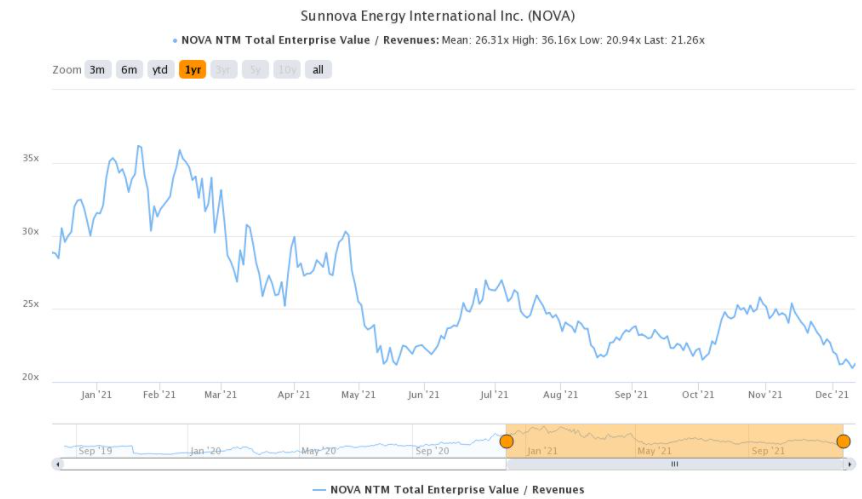

Sunnova is amongst the worst-performing solar stocks in 2021 and also has actually lost over a quarter of its market cap in the year. At The Same Time, Wall Street analysts see enormous advantage in the supply and its average target price of $56 is a premium of practically 70% over current prices. Of the 17 analysts covering the supply, 16 rate it as a buy or some equivalent while one expert has a hold ranking.

NOVA is amongst the preferred solar supplies among experts as is reflected in its rankings. Sunnova is among the leading domestic solar and also energy providers in the US. The company is additionally branching out right into EV charging as well as in October it introduced a partnership with ChargePoint.

NOVA is a fast-growing company and at the end of the third quarter, it had 176,900 customers., after it included 14,300 brand-new customers in the quarter. NOVA is among the best solar supplies that you can buy at a discount rate in December.

Altus Power

Altus Power is the most current solar play. The company has gone public with a reverse merging with CBRE Acquisition Holdings. The stock is trading only somewhat above the SPAC IPO price. However, it resembles a good solar play for the long-lasting at these prices.

Altus Power supplies located-sited solar generation, EV billing stations, and energy storage space solutions. The company has actually generated over 900 million kWh of solar power. The SPAC merger valued the mixed entity at $1.63 billion and also a 2024 venture value-to-EBITDA multiple of 7.1 x which looks fairly practical.

With Altus trading near the SPAC IPO price, the evaluations look rather affordable. While a lot of the firms that went public via the SPAC merging profession means below the IPO price, Altus looks a good buy as well as could join the ranking of business that have created financier wide range blog post the merging.

Also read