3 Out-of-Favor Solar Supplies to Purchase Currently

- First Solar is profitable, has a fantastic annual report, and also currently has a path to development.

- Array Technologies' stock has crashed in 2021, however there are factors to believe it can recover.

- Enphase's evaluation is a challenging tablet to swallow, however investors searching for a top-tier hyper-growth supply would certainly be hard-pressed to find a better alternative.

The solar sector has actually taken off onto the energy scene over the last 20 years as well as seems like it's not slowing down anytime soon. According to Our Globe in Data and also BP, complete solar installations globally have expanded from 0.65 gigawatts in 2000 to 40.1 GW in 2010 and 708 GW in 2020. That suffices to power 116 million U.S. houses.

Despite this development, not all solar power stocks have surpassed the market over the last twenty years. And also some stocks have befalled of support for one factor or one more. Three of our contributors think First Solar (NASDAQ: FSLR), Array Technologies (NASDAQ: ARRY), and Enphase Energy (NASDAQ: ENPH) are three of the supplies that might not be loved by the market however ought to be in your profile today.

Development is pertaining to this solar maker

Travis Hoium (First Solar): Solar panel makers have been kind of forgotten by the market for most of the last half-decade since they've had a hard time to produce the growth as well as earnings that financiers wished for. But financials are currently enhancing again as the sector matures and First Solar is once more looking appealing for capitalists.

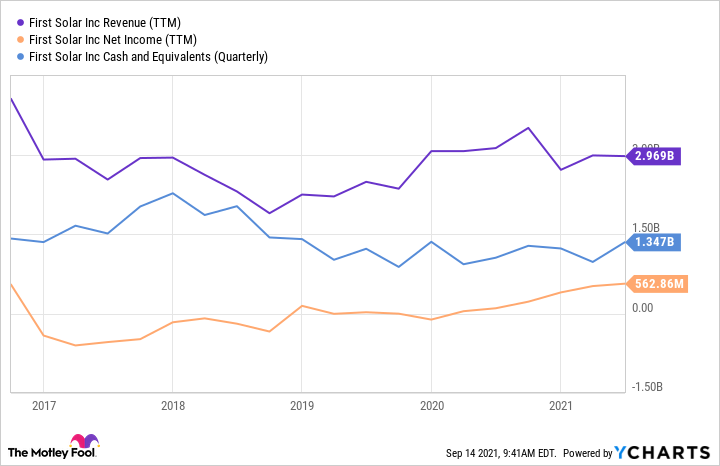

You can see below that in the past four years First Solar's profits has improved substantially, despite stationary earnings, and it continues to keep a strong cash setting. This improved economic picture is what gave administration the confidence to reveal plans to virtually double production capacity from under 8 GW this year to about a 16 GW run price in 2024. The improved scale ought to assist improve earnings, but it could also assist improve the bottom line as First Solar leverages its internal study to enhance item efficiency.

What I like regarding First Solar today is that it's moderately valued for capitalists, it has a lot of money, and also this could be a development supply in solar energy. On the price front, shares trade at 20 times incomes, which is relatively affordable in today's market. This is without pulling out the $2.1 billion in cash money on the annual report today or the $1.35 billion to $1.45 billion in net cash money that's anticipated to be on the balance sheet at the end of the year.

On the growth front, First Solar expanding manufacturing over the following 3 years ought to considerably boost its financial performance. And with shares trading at a reasonable assessment and the company's annual report looking second to none, this is a solar supply I would not forget.

Huge solar installments should continue to expand

Howard Smith (Array Technologies): It may not seem out of favor with the stockpile 40% in the past month, but shares of Array Technologies are still down 56% in 2021. The firm manufactures ground-mounted systems made use of in huge solar power projects. Array's stock dove 46% the day after it released its first-quarter revenues through ended March 31. Promptly raising input as well as freight prices caused the company to draw back support and assess its projects for earnings degrees.

Yet because that time, Array has actually gotten to supply arrangements that have fixed 85% of its input expenses for the equilibrium of the year. The firm stated in its second-quarter revenues report that almost all of its steel demands are currently secured for 2021, as the firm has both residential as well as global agreements with 2 steel providers.

The added exposure aided drive a partial recovery in the share cost over the past month. And the business itself must support it. Since June 30, Array had a record $882 million in complete performed contracts and also granted orders. As well as the nonreligious patterns in solar generation capacity growth need to continue.

A recent quick released by the U.S. Department of Energy stated that though solar has actually been the fastest expanding renewable energy source in the nation over the last years, the rate of growth has to increase. The report stated that to reach decarbonization goals, "solar implementation would need to accelerate to 3 to four times faster than its existing price by 2030." The DOE approximates that solar could grow from its existing level of 3% of generation to over 40% by 2035

Since Array can consist of well-known input expenses in project preparation, it can be certain to get appropriate returns. In the second-quarter report, company CFO Nipul Patel claimed, "We are currently seeing margins on new orders that are in line with our previous efficiency and in some circumstances even greater." That bodes well for future returns.

Enphase is throwing away no time at all returning to hyper-growth

Daniel Foelber (Enphase Energy): Investors in Enphase Energy have had a great deal to smile around as the supply has rebounded from a share rate of around $1 four years ago to $174 per share at the time of this writing. Enphase was added to the S&P 500 complying with a beast year where the business proved it might sustain growth (albeit at a lower rate) during the height of the pandemic. If Enphase had actually remained in the S&P 500 in 2020, it would certainly have been the second best-performing stock behind Tesla.

2021 has been a different tale. Enphase stock has actually lost a little heavy steam, currently placing in the bottom 20% of S&P 500 performers (and remained in the bottom 10% prior to its recent rebound). In reality, the stock's underperformance could be little more than simply slowing down after last year's close to sixfold increase. It appears counterproductive, however Enphase's 2021 underperformance might in fact benefit lasting investors. The firm presently trades at a borderline nosebleed evaluation contrasted to other top solar stocks. Giving the business an opportunity to grow into its assessment can provide it a more powerful baseline to beat the market in years to find.

Fortunately is that Enphase-- the company, not the stock-- has gone back to its breakneck development pace, producing the exact same quantity of earnings in its newest quarter as it did in all of 2019. In simply the first fifty percent of 2021, the company delivered around 4.81 million microinverters (1,626 megawatts DC) contrasted to 6.83 million microinverters (2,238 megawatts DC) in all of 2020.

|

Metric |

Q2 2021 |

Q1 2021 |

Q4 2020 |

Q3 2020 |

Q2 2020 |

Q1 2020 |

|---|---|---|---|---|---|---|

|

Microinverters shipped |

2.36 million |

2.45 million |

2.29 million |

1.44 million |

1.09 million |

2.01 million |

|

Megawatts DC |

796 |

830 |

762 |

478 |

355 |

643 |

Enphase's dominant placement in the U.S. solar microinverter industry, its growing energy storage space service, success in Europe, and also proceeded development in South America with Brazil and in Asia-Pacific via Australia indicate continual development on the international phase. Combine a large complete addressable market with the fact that solar prices remain to come down, and you have a company that might extremely well continue expanding at a quick clip.

Flight the wave of solar growth

Solar power continues to grow all over the world and also items like photovoltaic panels, racking, and also inverters are critical elements to that development. That's why First Solar, Array Technologies, as well as Enphase Energy are established to grow over the long term, making them terrific solar stocks for capitalists today.

Also read

- Zelestra Clinches $282m Financing for 220-MW Aurora Solar-Storage Hybrid Project

- Enfinity Boosts US Credit Facility to $245m for Solar Growth

- Ellomay Offloads Nearly Half of Italian Solar Portfolio to Clal

- Valeco Secures Solar Power Deal with French SMEs

- Eurowind Energy Commits EUR 175M to Romanian Solar Park