3 Leading Solar Stocks to Take Into Consideration Buying Today

- Using solar energy in power generation is expected to climb substantially in the years to find.

- Companies providing solar panels, inverters, and also power batteries, in addition to those associated with solar setups, are anticipated to profit directly from this growth.

Solar energy is readied to play an increasingly vital function in meeting global energy needs in the coming years. The UNITED STATE Energy Info Management projects that the share of sustainable resources in the nation's power generation market might double-- from 21% to 42%-- by 2050. Additionally, it anticipates solar energy to account for a little less than half of the renewable electricity generation by that year.

Though the expected development in solar energy is clear; what isn't as clear is which stocks need to you purchase to take advantage of this growth. Right here are three top solar supplies to consider contributing to your solar portfolio.

Canadian Solar

Amongst solar panel producers, Canadian Solar (NASDAQ: CSIQ) looks intriguing. In addition to making solar panels, the business is likewise involved in the development and sales of solar tasks. Canadian Solar derives about 47% of its revenue from Asia, 35% from Americas, as well as 18% from Europe and also all over else.

Canadian Solar has been expanding its income steadily throughout the years. In the second quarter, its earnings grew 105% over the pandemic-affected Q2 last year.

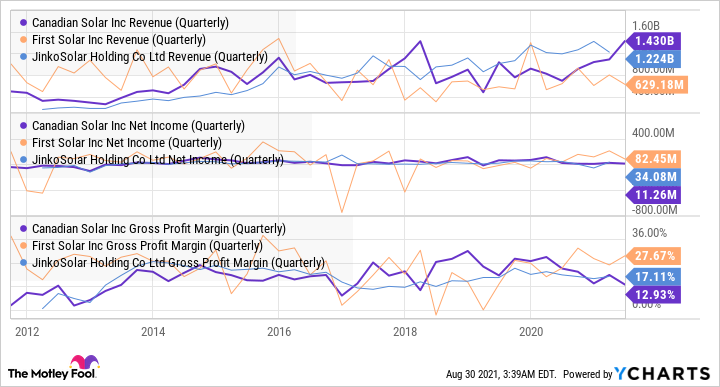

The company anticipates to create 14% to 16% gross margin in the third quarter. As the above graph shows, Canadian Solar is concentrated on growing revenue. It intends to proceed broadening margin over time. Canadian Solar supply is trading at an eye-catching forward price-to-earnings proportion of nearly 14, compared to around 36 for First Solar (NASDAQ: FSLR) as well as 11 for JinkoSolar (NYSE: JKS).

Along with solar panels as well as projects, battery power is a key development opportunity for Canadian Solar. It has 3 megawatt-hours of battery storage in operation. Further, it has 1.5 gigawatt-hours of storage unfinished with 0.8 GWh in its late-stage pipe. Furthermore, the firm has 17 GWh of battery jobs in the early or mid-stage pipeline.

Enphase Energy

Enphase Energy (NASDAQ: ENPH) is a prominent distributor of microinverters, which convert direct present created by photovoltaic panels right into alternating current-- a required action before the created power can be made use of. The business has actually been expanding its income impressively, with the most recent quarterly revenue rising 152% over the year-ago quarter.

Furthermore, Enphase has actually been generating impressive gross margins. In the second quarter, its gross margin stood at 40.4%. Enphase anticipates its gross margin to variety from 37% to 40% in Q3. Enphase Energy's remarkable development follows the company adopted a key financial target of generating a minimal 35% gross margin, while limiting general expenses to less than 15% of sales. Overall, the company looks well-placed to proceed growing in the years to find.

SunPower

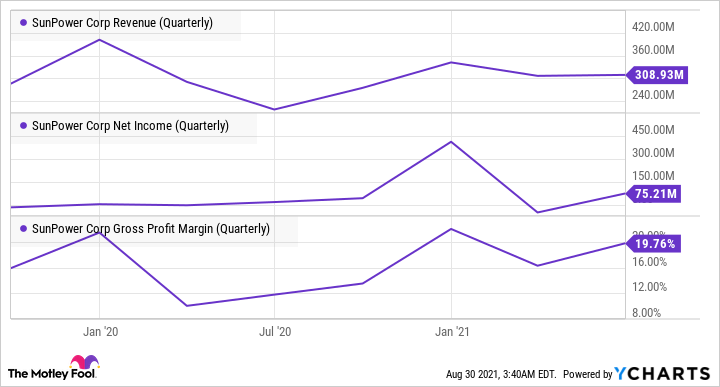

Over years, SunPower (NASDAQ: SPWR) has transformed its development strategy and emphasis numerous times. It currently focuses on property and industrial solar services with an asset-light strategy. After the spin-off of its panel manufacturing organization, Maxeon Technologies, SunPower's economic performance numbers are not directly comparable to its historical performance. Nevertheless, the company appears to be succeeding up until now.

In the second quarter, the business's gross margin improved to 19.8% from 11.8% in the year-ago quarter. It included 13,000 residential clients throughout the quarter and also has an overall property customer base of 376,000. Moreover, SunPower grew its brand-new residences stockpile by 10% sequentially.

SunPower has a number of eye-catching development avenues. Along with household solar setups, the firm is focusing on battery storage. In Q2, 23% of its property clients also went with SunPower's battery storage. Better, the business lately partnered with Wallbox, a carrier of electric car chargers, that will certainly permit home owners to bill their EVs with electrical energy produced from roof solar.

Overall, SunPower's recent development looks appealing. The stock looks well-placed to benefit from the anticipated development in the property solar market.

Also read