Top Energy Storage Batteries Stocks

Energy storage batteries is a promising sector for investment. However, to profit from stocks buying, it is essential to choose the right company to invest in. We have prepared a detailed overview of the firms involved in battery manufacturing whose shares are worth your attention.

See also: Top Energy Storage Companies | Storage News | Best Solar Storage Products | Top Energy Storage Batteries ETFs

Top Battery Stocks to Invest in

Battery stocks are underestimated by investors due to a number of issues that discourage them from buying the shares of companies specializing in energy storage solutions. However, with the growing demand for long-cycle EV batts as well as efficient small-sized batts for portable electronic devices, the sector seems very promising for future investments.

Like any other sector, battery stocks have a considerable challenge – to select the proper firm worth your investment. No company is protected from potential failures, but to reduce the risks let’s take a look at the most promising players in the battery industry.

Tesla (NASDAQ:TSLA)

No analysis of energy stocks can be imagined without mentioning Tesla – a pioneer in the industries of solar power and e-vehicles as well as an undisputable leader of battery production in the automobile industry. The corporation has its own batt manufacturing plant – Gigafactory, and is planning to open new facilities in the near future.

The only problem about buying Tesla’s shares is their expensiveness. In 2020, the stock price has increased twice and continues growing.

In 2019, the company acquired Maxwell Technologies. Apart from production of ultracapacitors, the latter is also involved in R&D of dry coating electrode tech for batts. Success in the technology development can improve efficiency of Li-ion batts, which would bring Tesla still further ahead of its rivals.

Panasonic Corporation (OTCMKTS:PCRFY)

Panasonic Corp offers a wide range of goods starting from TV sets to industrial equipment. The company has also shown interest in e-vehicles for a while.

The previous year and the beginning of the current one haven’t been favorable for the corporation so far. However, the perspectives for the future are promising.

The firm plans to cooperate with Toyota Motor in creating smart homes. The new cooperation will extend the partnership, where Panasonic will specialize in domestic appliances and batts while Toyota is going to make home-assisting robots.

So far, Panasonic has only supplied batts for Toyota’s e-cars. In 2019, the companies established a joint venture producing batts for electric vehicles, where Panasonic is the owner of 49 percent of shares. The goal of the collaboration is boosting batt capacity by 50 times as well as the development of solid state EV batts to replace the currently used Li-ion ones. This is likely to raise Panasonic’s revenue.

Another Panasonic’s advantageous partnership is with Tesla. The corporations cooperate in manufacturing of batts at Gigafactory, which is intended to raise both firms’ sales of their products. This collaboration makes Panasonic attractive for those who would like to invest in Tesla but cannot afford it.

Panasonic Corporation (OTCMKTS:PCRFY) stock prices →

Albemarle (NYSE:ALB)

Albemarle specializes in performance chemicals and is performing R&D of batt technologies. It is the leader in lithium production. Thus, in 2017, 36% of its total revenues came from selling lithium as well as Li hydroxide and carbonate.

In 2019, the firm’s EBITDA amounted to $226mln, while its revenue constituted $832mln. However, the company’s earning per share decreased by 5 percent to $1.23.

Anyway, Albemarle shares are not expected to remain 52-week low for a long time, due to the firm’s commitment to margins of 40 percent and the contracts signed for extended periods of time.

Thanks to the global growth of EV sales by nearly 60 percent, manufacturing of batts has risen, which has allowed the firm to perform $292mln lithium sales. For the rest of the year, the company experts forecast Li to be in much demand and the firm’s manufacturing to grow by 15-20 thousand metric tonnes, which is expected to raise its EBITDA by 17-19%.

Albemarle (NYSE:ALB) stock prices →

Enphase Energy (NASDAQ:ENPH)

Enphase’s stock price has been experiencing year-high, having boosted from about $8 to the current price exceeding $50.

The company is first of all known as a microinverter manufacturer, having shipped almost a million products.

The firm is still growing revenue in spite of shortage of components supply, which means prospects for still faster growth as soon as the current challenges are solved.

Enphase Energy (NASDAQ:ENPH) stock prices →

Energizer Holdings (NYSE:ENR)

Energizer is not only a batt manufacturer. It intends to grow into a leading producer of varied household goods.

Throughout 2019, the company’s shares were priced $37.50-40.50. However, the new year has started with a stock price rise up to $50, though the coming crisis has put it back to $37. Being well-established in consumer batt and entering vehicle batt sector, the company has good chances to raise its stock price.

To support its batt manufacturing business, the firm has acquired Battery and Auto Care. This is likely to bring Energizer to leading positions in the industry globally. The company has added new production facilities, not to mention optimization of its old plants.

The prices for merchantable Energizer’s legacy products have increased in the United States and are expected to rise globally until the end of the current financial year.

Energizer Holdings (NYSE:ENR) stock prices →

Johnson Controls (NYSE:JCI)

Johnson Controls, Inc. is the biggest auto batt producer. In 2020, the firm has sold its Power Solutions branch. Although the company’s batt unit has been sold, Johnson is strong in the market. Thus, its fire protection as well as HVAC and control units are within 4-6% rise.

As of the turn of the year, the company had a debt to equity ratio of 0.29. By selling the batt unit, the firm has diminished the debt by $3.4bln. Johnson can purchase Power Solutions back and raise its shares price within the following months.

Now, the firm’s backlog constitutes $8.8bln, which makes the prospects for the year quite favorable.

Johnson Controls (NYSE:JCI) stock prices →

Sociedad Química y Minera de Chile S.A. (NYSE:SQM)

SQM has been operating in Salar de Atacama, which has allowed the lithium producer to raise its sales forecast by 50 thousand tonnes.

The company’s stocks haven’t recovered yet after the yearly low resulting from the pandemic. There is no confidence whether the firm will be able to satisfy the demand growing due to high penetration of fully electric cars.

In case Sociedad Química manages to raise its capacity in 2020, it has a chance to reach the goal of 180 thousand metric tonnes production.

The company is not planning to raise the prices until the end of the year. It is rather oriented at long-term perspectives, such as the demand growth by 1,000,000 metric tonnes in a three year’s period and the corresponding production volumes to satisfy the demand.

Sociedad Química y Minera de Chile S.A. (NYSE:SQM) stock prices →

AES Corporation (NYSE:AES)

Having been in solar and solar+storage industry for more than ten years already, AES operates over 150 megawatts of projects in the United States and is currently developing or constructing another 300 megawatts.

The storage projects have been developed either directly by AES or via its joint venture with Siemens – Fluence. One of the firm’s large-scale projects is 100-megawatt AES Southland battery in Southern California awarded with a PPA for 20 years signed within the framework of $2bln repowering scheme meant to change the outdated gas power plants for more advanced technologies.

AES Corporation (NYSE:AES) stock prices →

General Electric Company (NYSE:GE)

The company has experienced some ups and downs in storage projects. However, recently its Reservoir solutions have succeeded. Until lately, the firm has been installing only small-scale batts of 30-megawatt capacity in USA and Canada. But its latest contract is for 100-megawatt storage solution for the 200-megawatt Solar River Project in Australia. The batt is estimated to come into operation next year.

General Electric Company (NYSE:GE) stock prices →

Vivint Solar (NYSE:VSLR)

Vivint is a small-cap company listed among bigger American energy firms due to its advanced solutions meeting the market demand, and the firm is promising a future revenue growth.

Solar+storage projects have become more demanded than adding batteries to the operating facilities. Such integrated plants have been installed in California and Hawaii. Vivint offers a kind of agreements to residential plant owners that will allow them paying a single rate for solar and storage. The storage system is intended for using within peak demand periods and in case of power failures. The firm installs PV arrays with no upfront expenses for homeowners in return of PPAs concluded for a period of 20 years.

Vivint Solar (NYSE:VSLR) stock prices →

SunPower

The company offers PV modules of higher efficiency compared to its rivals in commercial and residential solar. Apart from being among the largest solar installation firms in the United States, SunPower has started to produce solutions for energy storage, which makes it still more attractive for investors.

SolarEdge

The company manufactures inverters and other components, which are demanded by solar installation specialists. One of SolarEdge’s storage solutions is called StorEdge. The most promising field for the firm is combination of inverters, batteries and charging for e-vehicles.

Sunrun

Sunrun is a big player in residential solar sector. One of its storage products, BrightBox, is meant for providing backup power supply and allows saving money in peak hours. The solution features batts by LG Chem – one of the global industry leaders.

QuantumScape (QS)

QuantumScape QS stock prices →

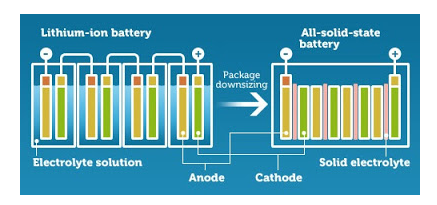

Solid-State Battery Stocks to Buy

All batt manufacturers are looking for innovative high-density solutions. A lot of R&D has been made in the field. One of the promising techs is solid-state batteries. The pro of such batts is elimination of possible leakage and corrosion, which can result in fire. Besides, solid-state batts can potentially be smaller and lighter compared to traditional ones. However, there are still quite a few issues to solve with solid-states. The first type of solid-state products that has become available commercially is thin-film batts. Such nano-batteries are similar in design to normal secondary cells, but they are extremely flexible and thin, which makes them suitable for tiny electronic devices.

Front Edge Technology (FET) has partnered with STMicroelectronics (NYSE:STM) for developing a batt of 200-micrometer thickness, promising over a thousand cycles half-discharged. Privately-held Fisker, Inc. is planning to produce EV batts by 2022. BMW and Volkswagen groups are also working on solid-state technologies.

Below you can find the table containing the promising firms in the solid-state batt market.

TOP Solid-State Battery Stocks

QuantumScape (QS)

QuantumScape QS stock prices →

|

1211.HK |

|

300750.SZ |

|

6955.T |

|

7004.T |

|

IKA.L |

|

5333.T |

|

5218.T |

Read also:

Top Solar indices | Top Solar Energy ETFs | Top Renewable Energy ETFs | Top Energy ETF | Energy Commodities | Energy Storage Stocks | Top Energy Storage Batteries Stocks | Top Solar Stocks | Best Solar Batteries | Top Energy Storage Batteries ETFs | Top EV Stocks