Energy storage and also network support

- As renewables infiltration rises, transmission and distribution (T&D) infrastructure will call for significant reinforcement. Battery storage is becoming a crucial option to conventional ways of enhancing network framework, because it is rapid to release, can offer numerous services, as well as frequently comes at a lower resources expense. IHS Markit analyst Oliver Forsyth delves into the added worth streams that reinforce the situation for grid-connected batteries.

When an area ends up being saturated with behind-the-meter solar, there can be issues with power backfeeding to neighborhood substations, which can damage network framework. Additionally, lines can come to be busy, restricting the quantity of power that can be exported, commonly leading to curtailment.

Energy storage space can solve much of these problems by balancing power generation with demand. Network operators and also energies are most frequently thinking about using energy storage to handle blockage, minimize outages, and give voltage assistance. Delaying network investment is absolutely a prospective benefit, however is not a service that a battery gives on a continuous basis. Offering capacity is not considered a network improvement, yet instead a generation assistance solution, and so is ruled out here.

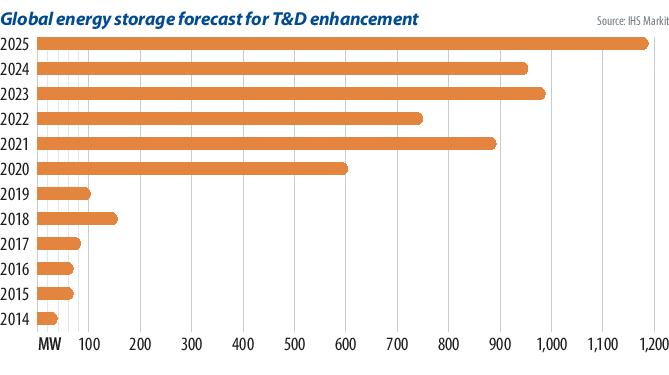

IHS Markit predicts that 5.4 GW of battery energy storage space will certainly be mounted globally for transmission and also circulation (T&D) network enhancement in between 2020 and 2025. The services that a T&D- improving storage system can give depend upon the place of the system, local guidelines, as well as problem of the network.

Storage space targets

As early as 2008, utilities in the United States made use of energy storage space as a non-wire option to traditional network support. Utilities are progressively identifying the advantages of storage to take care of blockage, reduce failures, and shave heights. Solutions are increasingly able to trade energy in wholesale markets and provide frequency regulation, generating extra earnings.

California, New York, and also Massachusetts in particular are driving this. These states not just have enthusiastic renewable resource targets, but also storage details targets, a considerable driver of the T&D improvement usage case. Each state has unique network concerns, along with common issues of time-shifting and also peaking capability that grow with increasing renewables generation.

Complying with the growing variety of wildfires in the state in the last few years, Californian energies are taking into consideration batteries to aid minimize the demand for public safety shutoffs, where power is removed to areas of the grid to reduce the threat of network facilities creating wildfires. On the eastern coast at the same time, New York City's population density has actually developed significant blockage concerns. Cities and also towns in Massachusetts sustained by solitary lines are in need of support to avoid interruptions and to manage congestion on these lines.

Third-party ownership

The requirement to unbundle vertically incorporated energy services (requested by Directive 2009/72/EC as well as 2009/73/EC of the EU) restricts the capacity of both transmission and also distribution system operators (TSOs as well as DSOs) from having and running storage space systems. Exceptions can be provided when particular criteria are met, yet these often come with limitations on what the systems can do and for how long. Instead, network drivers are creating brand-new markets for third parties to bid to give these services.

Historically, storage space for T&D enhancement in Europe has actually been dominated by presentation jobs. Italian TSO Terna, as well as France's RTE screening three 10 MW to 12 MW jobs in their corresponding nations in 2014 are just a few of the more prominent instances.

In Germany, a number of TSOs are intending massive (100 MW to 250 MW) batteries to provide 'virtual transmission lines.' In these jobs, numerous ESS will interact to anticipate the demand to reinforce regional lines. These huge projects are the exception as opposed to the policy, nonetheless. Rather it is becoming more usual for operators to have the system yet lease procedures to a third party, or develop a market for properties to bid their flexibility into. Local flexibility markets in the United Kingdom are one instance of this, however the fad is spreading. French DSO Enedis released its variation of regional flexibility markets in 2020, and the Netherlands has actually produced markets to capture distributed flexibility.

Australia's obstacle

An outcome of its distributed population, rough setting, aging framework, as well as the quick rate of renewables development, Australia is an expanding market for T&D improvement. Western Power-- a network driver in Western Australia-- is blazing a trail in utilizing ESS in fringe-of-the-grid places in place of standard network facilities. It is mounting solar+ storage systems behind the meter instead of brand-new lines, and it is introducing innovative neighborhood battery storage space systems that supply residents with the chance to acquire room in the system to store their solar energy (see p. 32).

This helps Western Power manage neighborhood blockage, progressively an issue in an area where one in three houses has solar. Front-of-the-meter systems-- particularly for assisting stuffed transmission lines-- will likely be a growing fad. Fluence recently recommended 2 250 MW/125 MWh ESS as opposed to a brand-new transmission line between Victoria and New South Wales. In 2018, it additionally constructed a 30 MW/30 MWh system in Ballarat to assist network driver AusNet handle congestion on its transmission network.

Decreasing financial investment

China had traditionally been a market leader in storage space as a T&D possession. Nevertheless, reforms omitting ESS from network expense calculations have stopped this. In other places, particularly in island areas, ESS are coming to be a lot more commonly utilized. This is driven by the unique capability of ESS to give a variety of services at the same time.

Internationally, there is a trend towards network drivers contracting out the operations of the ESS to a 3rd party. In some markets this will be to abide by unbundling requirements, however, for vertically incorporated utilities, it will certainly remain in order to take advantage of the competence of a 3rd party. These enhancement solutions are progressively only part of the worth pile. It is essential not to neglect that behind-the-meter storage space can support the grid by taking part in demand management programs as well as regional flexibility markets.